non filing of tax return meaning

Trade or business should be reported on. Interest compounded daily is also charged on any unpaid tax from the due date of the return until the date of payment.

Two Days Left To File Your Itr Income Tax Return Income Tax Filing Taxes

The Madhya Pradesh High Court has observed that mere non-filing of Income Tax Return would not automatically dislodge the source of income of the complainant in a cheque bounce case under Section.

. Comparing the advantages and disadvantages of being tax filer and non-filer source in FBR said that immediately after filing income tax returns the name of the filer would be enlisted among the active taxpayers whereas in case of failure in filing tax returns by due date the taxpayers would have to wait for one whole year to become active. Online By Telephone By Paper Note. Nonresident Alien Income Tax Return.

You or in the case of a partnership the precedent partner will face enforcement actions for any late or non-filing of your Individual Income. In addition to non-filing of the income tax returns within the due dates if the specified person does not furnish PAN to the payer then the TDS rate shall be higher of the rates mentioned above or 20. Flores the Supreme Court agreed with its investigating officer that evasion of income tax is a crime involving moral turpitude.

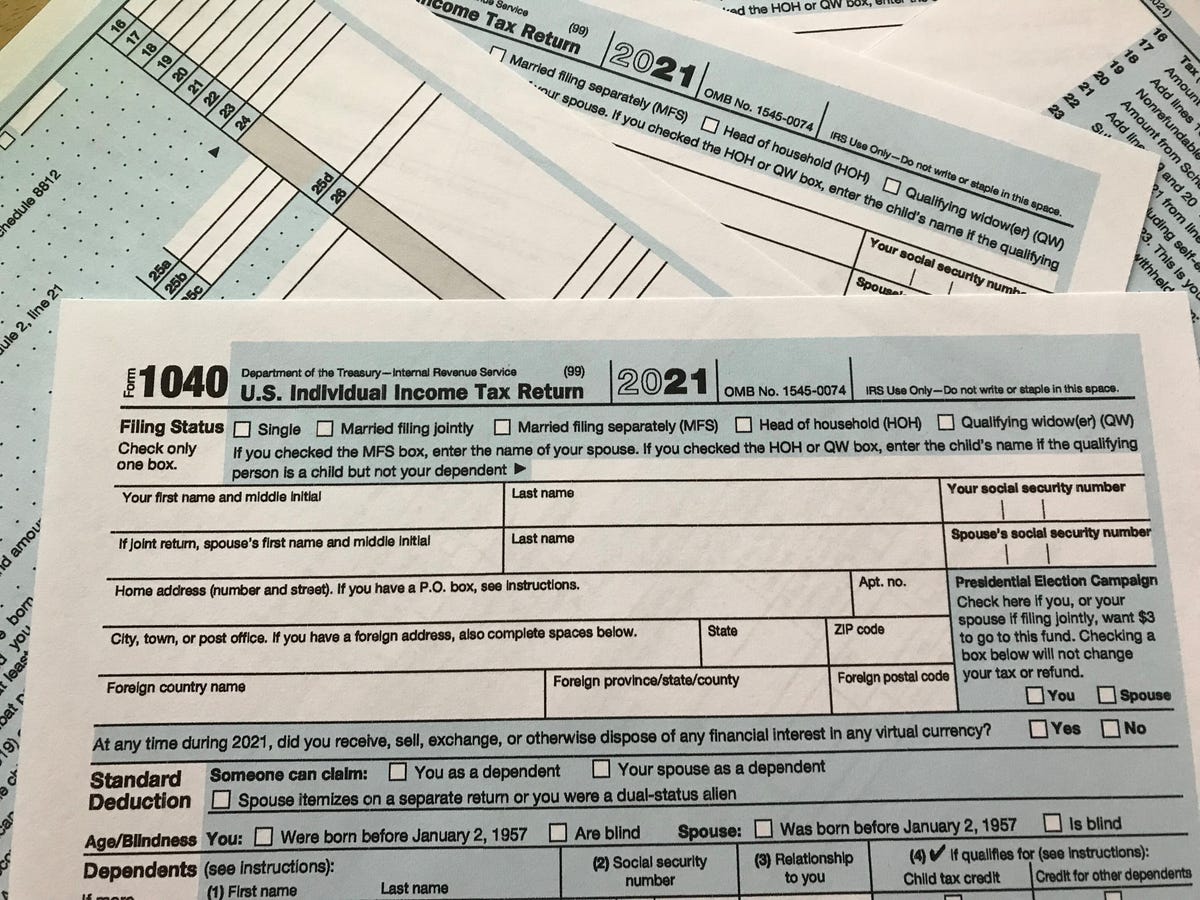

Effectively Connected Income should be reported on page one of Form 1040-NR US. The IRS is seriously behind in processing 2020 tax returns. An Income tax return ITR is a form used to file information about your income and tax to the Income Tax Department.

Both single and married taxpayers with and without dependents file. In case the return shows that excess tax has been paid during a year then the individual will be eligible to receive a income tax refund from the Income. Check the box for Line 7.

The recommended approach would be Define additional threshold definition. The user has two options to handle this scenario. The type of tax return filed by an individual.

Define additional threshold definition for specific TDSTCS type. Whether the non-compliance is a mere omission or a deliberate attempt to. Line 5 usually supersedes the address in Line 3 which means that while Line 3 is necessary answering line 5 changes where the letter goes to.

The tax liability of a taxpayer is calculated based on his or her income. Ad Use our tax forgiveness calculator to estimate potential relief available. Even if you are not engaged in a trade or business in the United States you must file a return if you have US.

In the 1979 case of Zari v. Follow prompts to enter the numbers in their street address that was listed on the latest tax return filed. Non Tax filers can request an IRS Verification of Non-filing of their 2017 tax return status free of charge from the IRS in one of three ways.

FDAP income is taxed at a flat 30 percent or lower treaty rate if qualify and no deductions are allowed against such income. Setup for TDS TCS at a higher rate for non-filer of return. Available from the IRS by calling 1-800-908-9946.

Select Option 2 to request a Tax TranscriptIRS Verification of Non-filing. Please visit us at IRSgov d click on Get a Tax Transcript. It says We received a request dated March 30 2020 for verification of non-filing of returns for the above tax period or periods.

We have no record of a filed Form 1040 1040A or 1040EZ using the above Social Security Number. Income on which the tax liability was not satisfied by the withholding of tax at. Tax Return to request copies of tax returns.

You must file a return if you are a nonresident alien engaged or considered to be engaged in a trade or business in the United States during the year. Under Tools o call 1-800-908-9946. Select Option 1 for English.

The non-filing and the non-payment of tax returns are two of the most common violations committed by the taxpaying public. The point is that failing to file a tax return should never be an option. You can quickly request transcripts by using our automated self-help service tools.

Late filing or non-filing of Individual Income Tax Returns Form B1BPM The large majority of taxpayers e-file their tax returns by the due date of 18 Apr each year or by 15 Apr if they paper file. Enter the tax year requested for Line 9. Non Applicability of this section.

Mail or fax Form 4506-T to the address below for the state you lived in. FDAP income that is not effectively connected with a US. This provision is not applicable to deduction of tax at source under 1.

We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. You can consider this letter a verification of non-filing The Tax Periord or Periods is December 2018. Tax filers must follow prompts to enter their social security number.

The total penalty for failure to file and pay can eventually add up to 475 225 late filing 25 late payment of the tax owed. This is due to many factors such as the pandemic completing processing of millions of 2019 tax returns stimulus payments unemployment compensation exclusion tax refunds changes in the tax code by Congress in the middle of the 2020 tax season and the like. Create additional withholding tax code and withholding tax group for specific TDSTCS type.

Consequently the defenders of Marcos Jr who readily admit that the crime. If the taxpayer wants the IRS non-filing letter sent to a different address use Line 5. Since failure to pay income tax which is tax evasion involves moral turpitude then non-filing of ITR also involves moral turpitude.

Individual Tax Return. If you filed a Puerto Rican or Foreign Income Tax Return you must submit appropriate non-filing documentation from a relevant tax authority.

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Income Tax Filing India Itr Filing Taxation Policy In India Filing Taxes Income Tax Income Tax Return

What To Do If You Receive A Missing Tax Return Notice From The Irs

Tashapb I Will File Your Uk Company Accounts And Tax Return For 105 On Fiverr Com Tax Consulting Corporate Accounting Filing Taxes

Filing State Taxes Alabama Begins Processing Returns Today What To Know Al Com

:max_bytes(150000):strip_icc()/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

Form 709 United States Gift And Generation Skipping Transfer Tax Return

Irs Letter 4903 No Record Of Receiving Your Tax Return H R Block

Section 206cca Higher Rate Of Tcs For Non Filers Of Income Tax Return Income Tax Return Income Tax Income

Top 8 Irs Tax Forms Everything You Need To Know Taxact

Understanding The 1065 Form Scalefactor

How To Register On The Income Tax Website And File Returns Income Tax Income Tax Return Filing Taxes

/cloudfront-us-east-1.images.arcpublishing.com/gray/L6QOIUO7NRFJ3ENZ4A52GTLCKU.bmp)

Don T Toss These 2 Important Stimulus And Child Tax Credit Letters From The Irs

Form 1040 U S Individual Tax Return Definition

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

3 Ways To Read A Tax Return Transcript Wikihow

Free File Can Help People Who Have No Filing Requirement Find Overlooked Tax Credits Internal Revenue Service

How To Fill Out A Fafsa Without A Tax Return H R Block

Structure And Ways To File Itr 2 Form And Given Detail About Eligibility To File It Https Www Mastersindia Co B Income Tax Return Indirect Tax Income Tax

:max_bytes(150000):strip_icc()/10402021-4522fd0d0a6d4ce392d3fd952db762fd.jpeg)